Business Insurance in and around Fort Wayne

One of Fort Wayne’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Auburn, IN

- Leo, IN

- Huntertown, IN

- Arcola, IN

- Angola, IN

- Huntington, IN

- Indianapolis, IN

- Carmel, IN

- Harlan, IN

- Grabill, IN

- Ossian, IN

- Yoder, IN

- Hoagland, IN

- New Haven, IN

- Bluffton, IN

- Allen County

- DeKalb County

- Roanoke, IN

- Wells County

- Noble County

- Whitley County

- Hamilton, IN

- Fishers, IN

- Westfield, IN

Cost Effective Insurance For Your Business.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or mishap. And you also want to care for any staff and customers who stumble and fall on your property.

One of Fort Wayne’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Protecting your business from these possible catastrophes is as easy as choosing State Farm. With this small business insurance, agent Rob Eicher can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

So, take the responsible next step for your business and call or email State Farm agent Rob Eicher to discover your small business insurance options!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

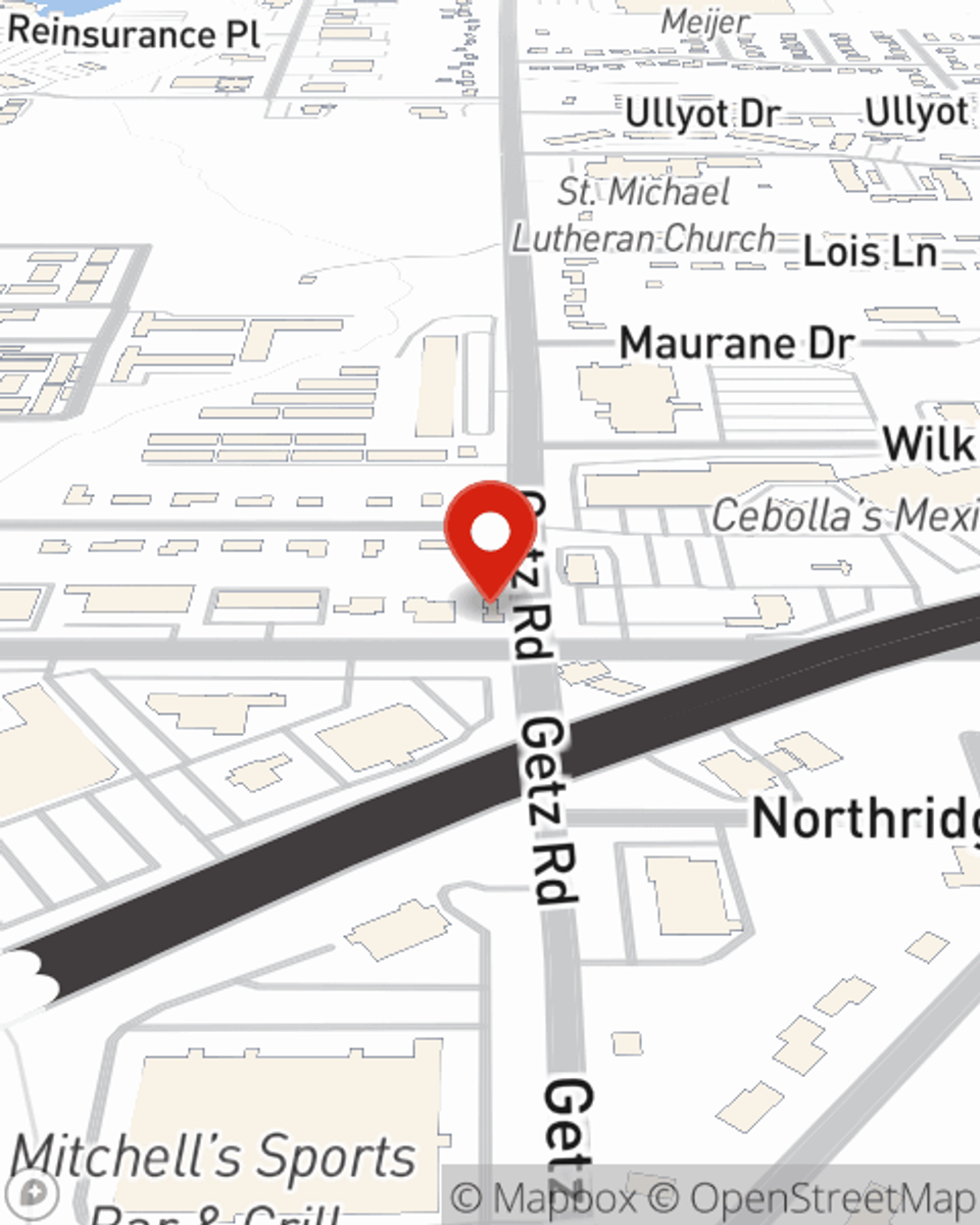

Rob Eicher

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.